michigan use tax filing

The following situations are the most common cases where you must pay this. Sales and Use Tax Information.

Please reference Michigans sales and use tax form webpage for more information.

. Individual Income Tax Preparer. Welcome to Michigan Treasury Online MTO. In Michigan that tax is called use tax.

To apply youll need to provide the Michigan Department of Treasury with certain information about your business including but not limited to. There are also other forms that you can use to file use tax only. As of 2016 Michigan has transferred from the old Michigan Business OneStop.

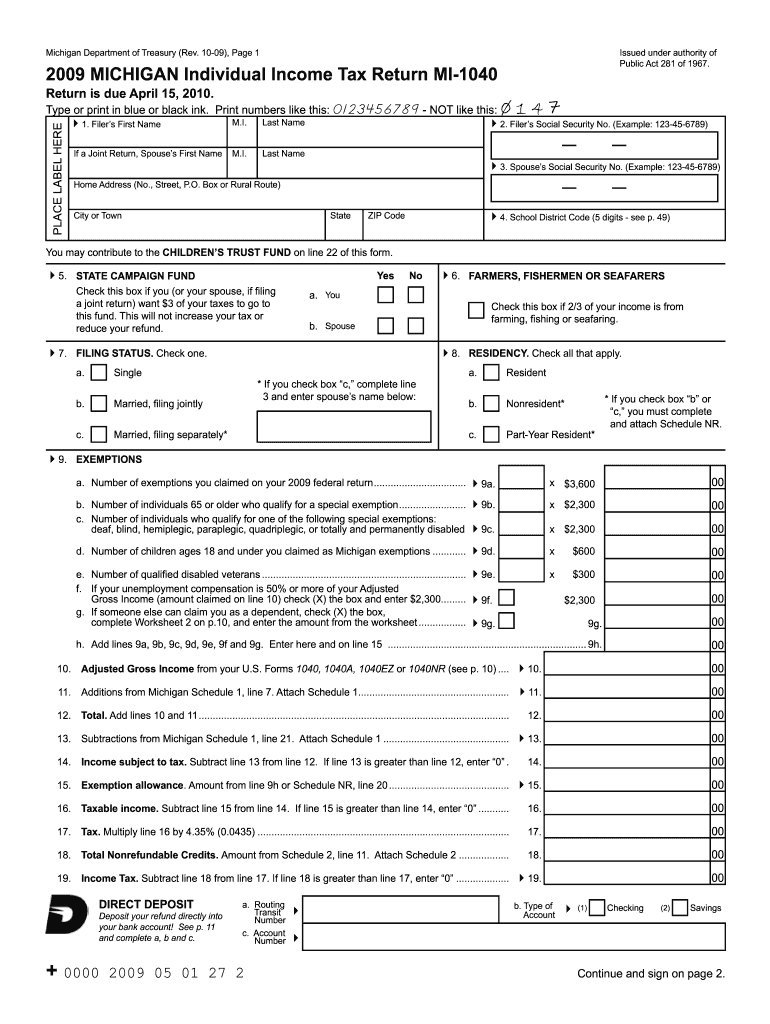

For Michigan residents the use tax is reported and paid on the annual Michigan income tax return MI-1040. Sales and Use Tax Filing Deadlines. Register or sign in to your eform2290 account.

All businesses are required to file an annual return each year. Welcome to Michigan Treasury Online MTO. MTO is the Michigan Department of Treasurys web portal to many business taxes.

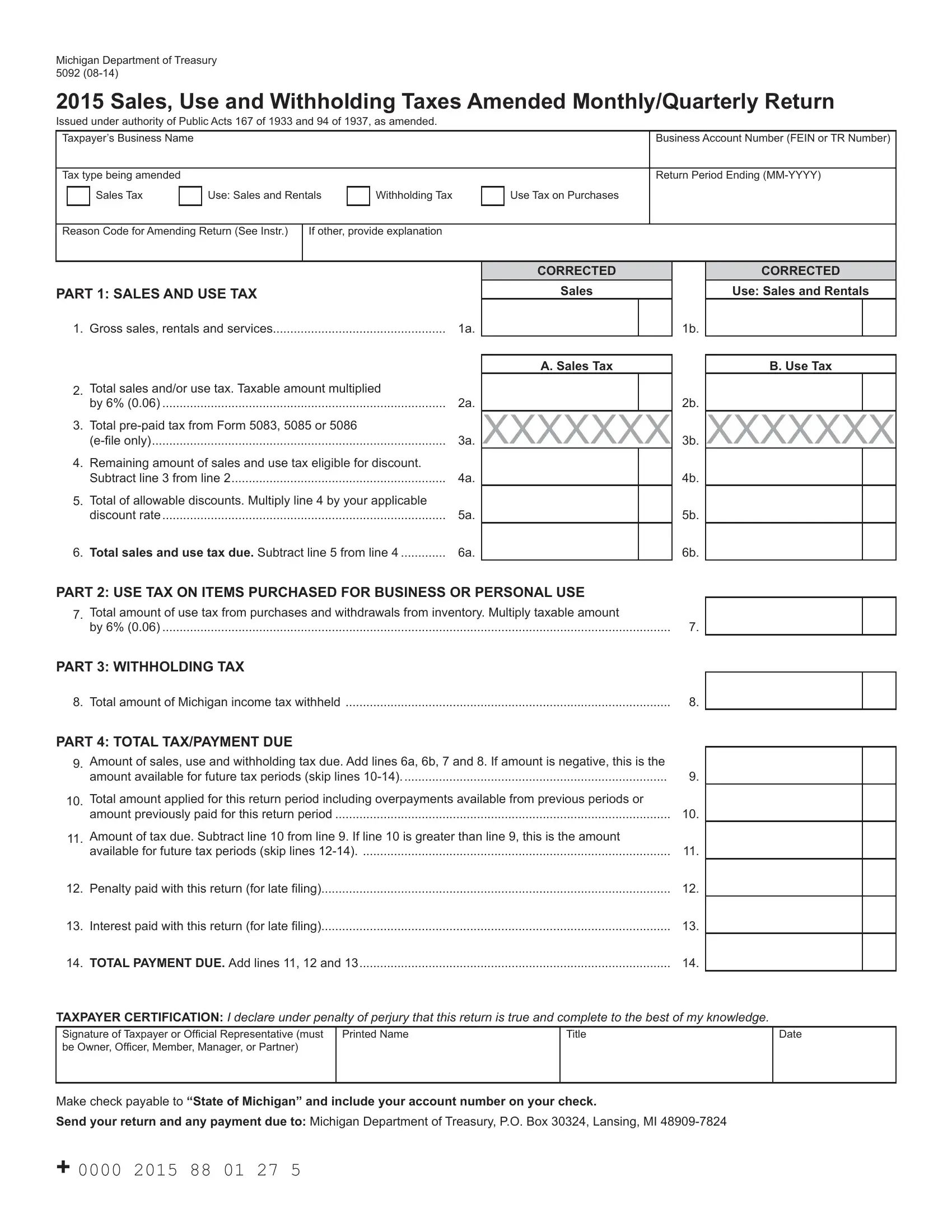

For businesses it is done on the same form as sales tax and. A taxpayer with an annual liability of less than or equal to 100 is not required to file or pay under the act. MTO is the Michigan Department of Treasurys web portal to many business taxes.

Employers with more than 250 employees are required to e-file the Sales Use and Withholding Taxes Annual Return Form 5081 and the Sales Use and Withholding Taxes. Use tax is a companion tax to sales tax. 2022 Retirement Pension Benefits Chart.

Michigan supports electronic filing of sales tax returns which is often much faster than filing via mail. 2022 Retirement Pension Estimator. For tax years of less than 12 months a taxpayers gross receipts filing threshold is.

Individuals and Businesses - Use tax on tangible personal property is similar to sales tax but applies to purchases when. E-File your Michigan Road Tax in 4 simple steps. Notice of New Sales Tax Requirements for Out-of-State Sellers.

The tax rate for Michigan LLCs depends on the amount of income the business earns and how it is taxed. Internet or mail order purchases from out-of. 2021 Retirement Pension Estimator.

When an LLC chooses to have their businesses treated as a. While the state allows. The Michigan use tax is a special excise tax assessed on property purchased for use in Michigan in a jurisdiction where a lower or no sales tax was collected on the purchase.

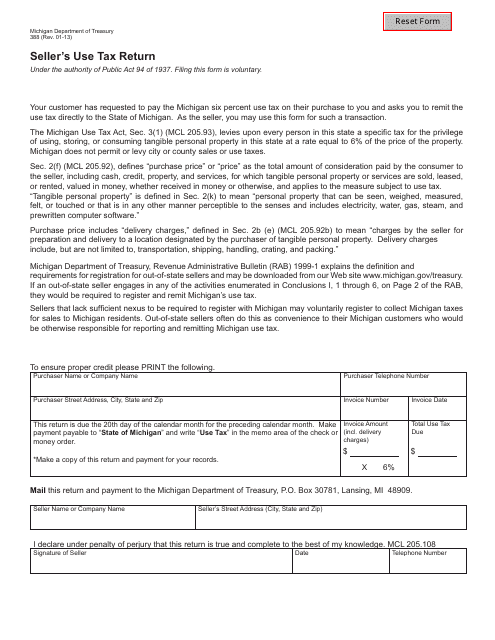

The first 50 payment is due on the 20th day of the current month. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales. How to Get Help Filing a.

Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought. Posted November 29 2017. Generally companies will want to use Michigan Treasury Online or MTO for short to register file and pay Michigan sales and use taxes.

Treasury is committed to protecting sensitive taxpayer. Treasury is committed to protecting sensitive taxpayer. You owe use tax for the following types of purchases unless you already paid at least 6 sales tax.

In order to register for use tax please follow the application process. Each year the Michigan Department of Treasury reviews all s ales use and withholding SUW accounts and determines if the business total. The Michigan use tax is an additional tax you claim on your return to represent sales tax that you didnt pay.

E-File your form 2290 by entering the details of your truck.

Michigan Tax Forms 2021 Printable State Mi 1040 Form And Mi 1040 Instructions

Michigan 2290 Michigan Dmv E File Hvut Form 2290

10 09 Page 1 2009 Michigan Individual Income Tax Return Mi 1040 Return Is Due April 15 2010 Michigan Fill Out Sign Online Dochub

Sales Taxes In The United States Wikipedia

Mi Dot 3372 2021 2022 Fill Out Tax Template Online Us Legal Forms

Treasury Make Sure Addresses Are Updated Before The 2022 Income Tax Filing Season

Tax Preparation Services For Businesses In Michigan What You Need

Form 388 Download Fillable Pdf Or Fill Online Seller S Use Tax Return Michigan Templateroller

Deadline To File Michigan Taxes Extends To May Wwmt

How To File And Pay Sales Tax In Michigan Taxvalet

Michigan Form 5092 Fill Out Printable Pdf Forms Online

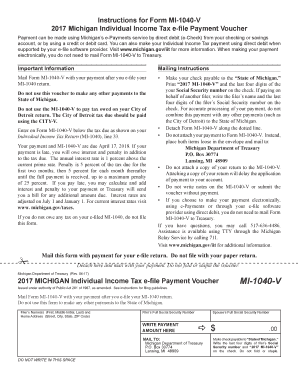

Michigan Individual Income Tax E File Payment Voucher Form

Michigan Sales Tax Compliance Agile Consulting

Individual Income Tax Returns Due In Less Than A Month

78 Sales Tax Use Tax Income Tax Withholding State Of Michigan

East Lansing Extends Income Tax Filing Deadline To June 1 Wlns 6 News

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Filing A Michigan State Tax Return Things To Know Credit Karma